122018 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. 50 income tax exemption on rental income of residential homes.

Singapur Singapore Travel Aerial View Singapore Photos

Its paid to the local authorities who set their own rate but its most often around 4 of the rental value.

. Now in 2019 the time has come for property owners to begin claiming that exemption on their income tax forms. The legalese gets complicated so lets break. Assessment Year 2018-2019 Chargeable Income.

100 US 400 MYR. For applications received by the Securities Commission of Malaysia from 1 January 2018 to 31 December 2020. Nonresidents are taxed at a flat rate of 26 on their Malaysian-sourced income.

You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. 19 December 2018 DIRECTOR GENERALS PUBLIC RULING Section 138A of the Income Tax Act 1967 ITA provides that the Director General of Inland Revenue is empowered to make a Public Ruling in relation to the application of any provisions of the ITA. Malaysias prime minister presented the 2018 Budget proposals on 27 October 2017 and announced a slight reduction in individual income tax rates and partial exemption of rental income.

Tax Exemption on Rental Income from Residential Homes Received by Malaysian Resident Individuals. This tax is known in Malaysia as cukai pintu. On the First 2500.

The exemption is applicable for each property if Adam has in excess of one property in this category. Alternatively the homeowner may own a land larger than 1 acre or earn more than RM 500000 through yields from the properties. Property taxes can be troublesome and.

Rental income is taxed at a flat rate of 26. This was introduced in Section 4 d of the Income Tax Act 1967 ITA. In order to promote affordable accommodation to the.

The idea is that income from the renting of residential properties would receive a 50 exemption from income tax. As we mentioned earlier this is an offence. Calculations RM Rate TaxRM 0-2500.

Tax exemption on rented home rental income of 50 for rental income up to RM2000 per month to Malaysians residing in Malaysia. As unfortunate as this may sound the government has announced other tax reliefs for 2020. To encourage Malaysian resident individuals to rent out residential homes at reasonable charges Malaysia budget 2018 announced that 50 income tax exemption be given on rental income received by Malaysian resident individuals in year of assessment 2018 subject to the following conditions.

Income RM YA 20182019 Tax RM on excess 5000 0 1 20000 150 3 35000 600 8 50000 1800 14 70000 4600 21 100000 10900 24. The government of Malaysia is offering 50 income tax exemptions for three consecutive years 2018 2020 to individuals who rent out their residential properties at a rate not exceeding RM 2000 per month for each property. Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file.

Special classes of income. Fourth Adam is able to claim 50 exemptions on the tax on rental income if he. Because of this many landlords have failed to include their rental income when submitting their tax forms.

On the First 5000. Prior to Jan 1 2018 all rental income was assessed on a progressive tax rate ranging from 0 to 28 without any tax incentive or exemption. Applicable for Year Assessment YA 2018 to 2020.

1 There is also a revised treatment of real property gain. Rental of moveable property. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any.

CAPITAL ALLOWANCE FOR INFORMATION AND COMMUNICATION TECHNOLOGY ICT EQUIPMENT AND SOFTWARE. Personal income tax in Malaysia is charged at a progressive rate between 0 28. To have commercial property to be taxable under the 6 GST the homeowner must own 2 or more commercial properties or a commercial property valued at more than RM 2 million.

Its a tax based on the rental value of a property paid by the owner. Income-generating expenses are deductible from the gross rent such as interest expense cost of repairs assessment tax quit rent and agents commission. Rents out his residential properties at a rate below RM 2000 a month.

In 2018 some individual tax rates have been slashed 2 for three slabs Chargeable Income Bands 20001-35000 35001 50000 50001 -70000 will now be taxed 3 8 14 respectively. The rental value of the property is calculated according to the property type and location. 1 The property is jointly owned by husband and wife but then taxed separately 50 upon each partner.

This report covers some of the important measures affecting individuals in Malaysias 2018 budget. Income tax in Malaysia is imposed on income. Income-generating expenses such as quit rent assessment repairs and maintenance fire insurance service charge sinking fund and management fees are deductible.

Chargeable income RM54000 Taxable Income RM9000 Individual Tax Relief RM5940 EPF contribution tax relief RM39060. Tax Exemption On Rental Income From Residential Houses. She would need to pay RM600 on the first RM35000 and 8 on the remaining RM4060 RM32480 which totals to RM92480.

2 Exchange rate used. Depreciation does not qualify for tax deductions. Calculations RM Rate TaxRM.

2018-2020 the plan was dropped and it was only allowed for 2018 tax claims. Her chargeable income would fall under the 35001 50000 bracket.

Everything You Should Claim For Income Tax Relief Malaysia 2021 Ya 2020

Advances In Taxation Pdf Free Economics Books False Book Portfolio Management

Retirement In Malaysia Part 9 Culture People Retirepedia Malaysia Culture People

7 Rm 68 000 Adjusted Income Capital Allowances For Chegg Com

21 Dec 2018 Investing Investment Tips Investment Property

Corporate Income Tax In Malaysia Acclime Malaysia

Pdf Land Tax Administration And Practice In Malaysia A Review On Institutional And Governance Issues

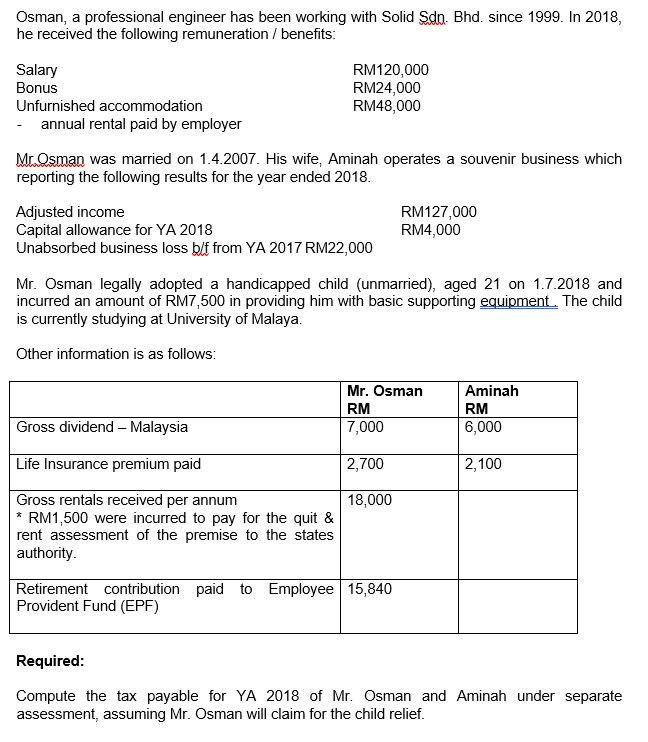

Solved Osman A Professional Engineer Has Been Working With Chegg Com

4 Dec 2018 Investing Activities Financial

How Is Foreign Sourced Income Taxed Thannees Articles

Malaysia Malaysian Tax Enforcement In 2020 Updates Bdo

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

New Free Stock Photo Of Hand Pen Writing Tax Guide Inheritance Tax Tax Deductions

21 Sept 2020 Forced Labor Infographic Crude

8970 Sw 63rd Ct Pinecrest Fl 33156 Contemporary House Pinecrest Home

How Is Foreign Sourced Income Taxed Thannees Articles

You Made A Mistake On Your Tax Return Now What

Maybank Gold Investment Account Campaign In Malaysia Gold Investments Investment Accounts Investing